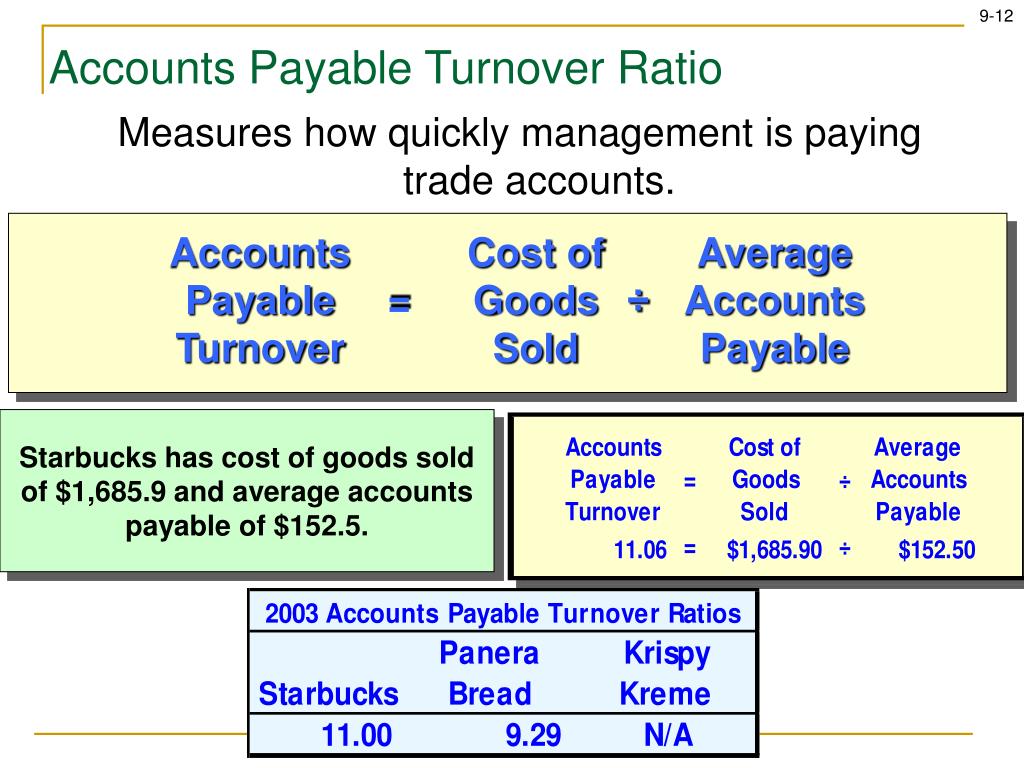

Second, the business is not effectively monitoring all payables. First, there might be a cash flow problem. The business’ inability to settle payables could translate into many things. Detecting poor A/P management: A low A/P turnover is an indication of poor A/P management.While analyses are not necessarily conclusive, a high turnover may indicate a high cash position, while a low turnover may indicate a low cash position. Assessing the cash position of the business: The A/P turnover can provide information about the business’ cash position by looking at how many times the business pays its payables.Otherwise, the latter would mean that the business is not reinvesting excess cash to improve business operations to generate more revenue. If it’s the former, it may affect the business’ credit score and reputation with vendors. The A/P turnover can reveal if the business is struggling with or swimming in cash. Spotting inefficient cash management: In relation to the first bullet, a high and low cash position may indicate inefficient cash management.You may check IBISWorld for industry-related ratios and information. Hence, it’s best to look at companies within the same industry to determine if your business’ A/P turnover is within the normal level. There are industries wherein a high or low A/P turnover is normal. However, the meaning could change if compared with industry standards. Comparing against industry standards: A high or low A/P turnover may mean a lot of things if analyzed individually.Here are some ways that you can use the A/P turnover: The A/P turnover ratio is one of the financial ratios used in financial ratio analysis. Understanding the Accounts Payable Turnover Ratio

#Accounts payable turnover ratio equation software#

Our list of the best small business accounting software can help you find the solution that fits your needs. Generate A/P reports faster by using accounting software.

0 kommentar(er)

0 kommentar(er)